Financing agribusiness in Nigeria is perceived as difficult, high risk, and insufficient by many. This study aims to provide an objective and comprehensive overview of supply and demand for agricultural finance, current gaps, and potential solutions that have been identified in Nigeria, Africa and the rest of the world. The research was commissioned by the Embassy of the Netherlands to Nigeria and conducted by Agri-Logic.

The aim of the report is to explicitly inspire stakeholders to action in improving access to finance. A thorough understanding of current agricultural access to finance in Nigeria can inform recommended interventions for government and development programs, and opportunities for entrepreneurs as well as providers of financing.

The report distinguishes real risk from perceived risk, while highlighting gaps in supply and demand, and illustrating solutions and best practices. The report aims to understand the status of access to agricultural finance across sectors, the value chain, and states in Nigeria, with a focus on those most relevant to the objectives and most relevant to bilateral relations between the Netherlands and Nigeria.

Sector characteristics

Agriculture and agribusiness are widely recognized as being critical for development. The sector in Nigeria is characterized by:

- Production of crops, livestock and aquaculture, with staples for domestic processing and consumption; and cash crops for export value.

- Smallholder farming with many subsistence farmers and often low productivity. Commercial farmers are less than half of the farmer population.

- A largely informal economy and entrepreneurship: SMEs are significantly contributing to GDP, yet often not registered and with limited scalability.

- Policy and legislation is often focused on incentivizing domestic production and self-sufficiency, often by trade regulation for import or limiting access to foreign currency.

- With a growing population, challenges in infrastructure, and trade barriers, the country has high and increasing food prices and self-sufficiency is not yet in sight.

Demand and supply

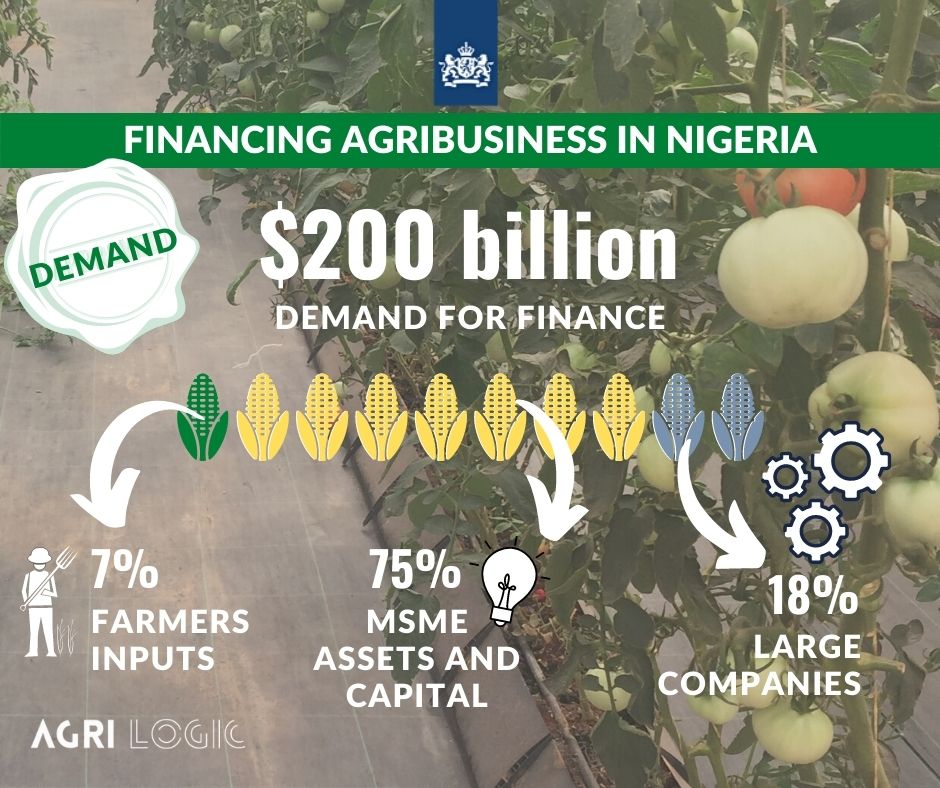

The total demand for agricultural finance is estimated at ₦83 trillion ($200 billion). Demand for financing roughly falls into three categories: farmers short term finance for inputs, MSME medium to long term finance for assets and overheads, and large and multinational companies short term working capital and long term investment in productive assets.

The total supply of agricultural finance is estimated ₦1.6 trillion ($4 billion), with an additional ₦6 trillion ($15 billion) self-financed by entrepreneurs.

Banks are the largest provider of agricultural finance in Nigeria, even though agriculture only represents ~5% of their total loan portfolio. Bank funds for agriculture grow ~35% annually. Nigerian banks generally have liquidity, but stakeholders have reported collateral requirements, lack of knowledge, currency and market risks, and lack of a rural branch network as challenges.

Public schemes by CBN and others are a significant source of funds for agriculture and agribusiness, and are the largest actor that is facilitating inputs credit to farmers and providing medium term finance to SMEs. These funds however do struggle with low repayment rates and as such have limited scalability.

Value chain finance is disseminated through traders or processors as an aggregator, and while there is a strong business case to build on commercial relationships, aggregators are not always willing and able to scale considering that financial services are not part of their core business capability.

Financing gap

Based on a bottom-up estimation of demand and supply, the financing gap for agricultural finance in Nigeria is ₦76 trillion ($183 billion), roughly 90% of total demand for agricultural finance.

The financing gap is largest for medium term and medium sized debt, revealing a missing middle. However, considering the very large finance gap for all financial instruments and transaction sizes, the missing middle should not be the only focus. While supply of agricultural finance grows with an average 29% annually, compared to a demand growth of 15%, this is insufficient to catch up with the finance gap, which could have doubled by 2027.

Weaknesses of the sector that underly the very large access to finance gap relate to collateral, knowledge and profitability. Stakeholders report corruption, policy and security as specific concerns for Nigeria. In addition, market volatility, weather and supply chain dependencies are risks that are common to agribusiness globally. For entrepreneurs, innovators and investors, sector knowledge, a safety net through savings or insurance, diversification and partnerships are the key elements for risk mitigation.

Way Forward, Returns and Impact

The authors call on all stakeholders to focus on the most scalable and impactful solutions in each segment:

- Informal community schemes are the most appropriate solution for a large segment of smallholder farmers, and can be scaled through public and private extension services. This can also be a solution for MSME services such as aggregators or inputs dealers on community level.

- Value chain finance builds on existing commercial structures to reach commercially viable smallholder farmers, and needs alternative collateral solutions, de-risking, and data to become scalable. This could potentially be achieved in partnership with MFBs who leverage fintech.

- Banks have liquidity, interest and incentive to invest in agribusiness, and combined knowledge and tools for agribusiness and SME investing can support the growth of this segment. Funds as an indirect investment vehicle could also provide a solution for those banks who are not able to build agribusiness expertise.

- Fintech and agritech can reduce risks and reduce transaction cost through data and targeted solutions. By developing solutions that appeal to asset managers, pension funds, investment clubs and diaspora, fintech offer the opportunity to tap into sources of funding not currently accessible for agribusiness.

These combined interventions can generate an additional supply of finance of ₦30 trillion ($73 billion) by 2030, improve livelihoods for 50 million people, enable production of an additional 125 million MT of food, and contribute ₦35 trillion to GDP. Banks and fintech have the potential to contribute the largest supply of financing to the sector, whereas informal schemes and value chain finance can have the largest impact on livelihoods and food security. While these combined interventions can reduce the finance gap significantly, this is insufficient to close the gap fully.